As billions of people face extreme heat warnings,droughts, wildfires and catastrophic flooding, our vulnerability to climate change has never been clearer. We must urgently start identifying the physical climate risk most likely to impact our assets, so that we can adapt to the inevitable climate volatility yet to come. But what exactly is climate risk, why does it matter, and what can be done about it?

“Every company, investor, & bank that screens new & existing investments for climate risk is simply being pragmatic.” -Jim Yong Kim, Former President of the World Bank

The former president of the World Bank said this very quote in 2014 in Davos during the World Economic Forum. This was ten years ago – a year before the Paris Agreement was signed and also a year before Basel-based Financial Stability Board (FSB) created the Task Force on Climate-related Financial Disclosure (TCFD). Since then, the world has continued to warm, breaking record temperatures year after year.

In those ten years, the world has seen climate change impacts like it has never seen before – record number of wildfires, a doubling of the number of people globally who face food insecurity, extreme rainfall causing heavy floods, extreme heat with some cities experiencing over 50C in the summer, and long-term drought. These are only some examples of climate change risks that we are facing, and more climate change risks await in the future as the world continues to warm.

It is crucial then that businesses protect themselves in the face of climate change risks. Below we discuss what climate change risk is and the different kinds of risks that businesses face, climate risk disclosure, climate risk in finance, and the importance of climate risk assessment in climate risk management.

What is climate risk?

In recent years, the term "climate risk" has become increasingly prevalent in conversations surrounding environmental sustainability and global resilience. As the impacts of climate change continue to intensify, understanding and mitigating climate risk has never been more critical. But what exactly does climate risk mean?

Climate risk is the potential for climate change to create adverse consequences for human or ecological systems. This includes impacts on lives, livelihoods, health and wellbeing, economic, social and cultural assets and investments, infrastructure, services provision, ecosystems, biodiversity, and species.

Climate risks leave organizations vulnerable to climate change impacts and have financial consequences. These financial consequences can be far-reaching. For example, in the construction sector in the UK, research found that project timelines are being extended by an average of 21% because of unpredictable weather patterns, costing £2.2 billiion each year. Data also shows communications services to be at most risk of climate impacts. Flooding, freezing, and other extreme weather events in the UK, for example, have caused outages in broadband connections due to infrastructure damage. The stakes are high, and reducing uncertainties is critical for businesses.

Every organization in every sector, in every part of the world, faces varying degrees of climate risk – and that risk is escalating as climate change accelerates. In 2021 alone, extreme weather events caused USD329 billion in economic losses – 45% higher than the 21st-century average, says a report by Aon. In 2022, the losses were reported to be USD313 billion. These catastrophes are “increasing in frequency and severity,” it notes.

In the coming decades, the impacts will be felt globally: a report from McKinsey warns that of the 105 countries it assessed, which represent 90% of the world’s population and 90% of global GDP, all “are expected to experience an increase in at least one major type of impact on their stock of human, physical, and natural capital by 2030.

Intensifying climate hazards could put millions of lives at risk, as well as trillions of dollars of economic activity and physical capital, and the world’s stock of natural capital.” The severity of these outcomes will be determined by the ability of individuals, organizations and governments to understand climate risk, and take effective adaptation actions to reduce it.

There are two types of climate risk that companies need to be aware of: physical climate risk and transition climate risk – each with its own drivers, challenges and consequences for organizations.

What is physical climate risk?

Physical climate risk describes the potential for physical damage and financial losses as a result of increasing exposure to climate hazards resulting from climate change. It takes into account both the direct physical impacts of climate change (such as floods destroying infrastructure), and direct and indirect socioeconomic responses to climate change (such as losses caused by direct damage to assets which prevents their operability, and the costs of repairing that damage).

According to the Intergovernmental Panel on Climate Change (IPCC), physical risk “results from the interaction of vulnerability, exposure and hazard". It is the combination that reflects the complexity of a person’s, community’s or organization’s exposure (how likely they are to experience) to hazards (climate phenomena that can cause damage), factoring in their vulnerability (how well-equipped they are to withstand a climate event).

Physical climate risks can be either shocks or stresses. Shocks – such as floods, storms or wildfires – are discrete, destructive and relatively short-lived. Stresses are slow in their onsets, such as changes in precipitation, rising temperatures and seasonal shifts.

These sustained shifts in climate patterns can have long-term effects on supply chains, property value and insurability. The Task Force on Climate-related Financial Disclosure (TCFD) describes climate shocks as acute risk, and climate stresses as chronic risk. Their impact can be gradual, but escalate over time. Many cannot be reversed.

Climate shocks are “occurring with greater frequency on both a regional and global basis”. Climate shocks and stresses can occur at the same time and impact each other, creating compound risks and cascading failures. For example, coastal flooding risks (climate shock) are exacerbated by sea-level rise (climate stress).

As climate change accelerates, overall physical climate risk will continue to grow, often in non-linear ways – making it complex for organizations to adequately understand and plan for. Yet the costs of not doing so are severe: “the socioeconomic impact [of physical climate risk] increases between roughly two and 20 times by 2050 versus today’s levels,” says McKinsey.

Other studies have included responses to climate change as part of the equation as responses to climate change can decrease or increase climate change risks for organizations. For example, phasing out fossil fuels can limit global warming, which can reduce future physical climate change risks like drought and wildfires.

What is transition climate risk?

Transition climate risks are business risks related to a transition away from fossil fuels and other greenhouse gas (GHG)-emitting activities. Decarbonization is critical to stabilizing the climate long-term, a process which will result in social, political and economic changes.

The cost of decarbonizing assets and operations is a transition risk, yet businesses that fail to decarbonize also face other types of transition risk such as reputational loss, loss of market share and regulatory consequences.

The energy sector is at the nexus of transition risk. About 80% of the world’s global energy use today is produced by fossil fuels. The rapid transition away from these energy sources by mid-century creates transition risks for organizations that produce or rely on them.

Energy producers face the dwindling value of their fuel reserves, and their infrastructure such as pipelines, drilling rigs and power plants risk becoming stranded assets. Downstream, businesses that rely on fossil fuel products or energy sources run the risk of disruption to their supply chains and operations.

The connection between physical and transition risks

Physical and transition risks are inextricably linked. As physical risk increases, so too does transition risk. As the physical risk of extreme heat events rises, so do the costs of either action or inaction – transition risk is inherent in either choice.

Owners of a manufacturing plant at high physical risk of heat waves can either adapt their asset, or continue business as usual. If they choose to adapt, the associated costs of relocating and retrofitting the asset represents a transition risk to the business that must be taken into account. If they choose not to respond to their physical risk, they face loss of revenue arising from reduced workability or operability, and the depreciation of their asset as competitors adapt.

Only by considering both the physical and transition risk to their assets across different time periods and climate scenarios can organizations make fully informed decisions about how best to protect their business from inevitable climate-related risk.

Climate risk disclosure

Climate risk disclosure is a crucial component of climate risk management, ensuring transparency and accountability in how organizations assess and address climate-related risks. At its core, climate risk disclosure involves companies and financial institutions disclosing information about their exposure to climate risks, including physical, transitional, and liability risks, as well as their strategies for managing and mitigating these risks.

The Task Force on Climate-Related Financial Disclosures (TCFD) provides a framework for effective climate risk disclosure, guiding businesses in assessing and disclosing climate-related financial risks and opportunities. While the FSB established the TCFD in 2015, starting 2024 the International Sustainability Standards Board (ISSB) is set to take over the TCFD.

Many countries recognize the need for businesses to be more transparent about the climate risks they face and already have climate risk disclosure reporting in place, with the United States being one of the latest countries to to require climate risk disclosure reportin (however, as of April 2024 the US Securities and Exchange Commission (SEC) while it fights the ruling in court after the US Chamber of Commerce filed a lawsuit against it).

By encouraging voluntary disclosure aligned with the TCFD recommendations, organizations not only comply with a legal necessity, they can also enhance their understanding of climate risks, strengthen resilience, and make informed investment decisions.

Climate risk in finance

The question of whether fund managers accurately estimate climatic risk has become increasingly important. Despite growing awareness of the financial implications of climate-related hazards and disasters, evidence suggests that many fund managers may be underestimating the true magnitude of these risks.

Investors have a critical stake in understanding and addressing climate risks, as these factors can significantly affect the performance and stability of investment portfolios. From physical risks such as extreme weather events and sea-level rise to transitional risks like policy changes and technological advancements, climate-related factors pose complex challenges to financial markets.

Failing to adequately account for climate risks can lead to substantial financial losses and reputational damage for investors. By incorporating climate risk assessment and mitigation strategies into investment decisions, investors can enhance portfolio resilience and position themselves for long-term success in a rapidly changing world.

How to quantify climate risk

Quantifying climate risk is critical in climate risk management. One way for businesses and fund managers to better understand the climate risks they face is by quantifying them. There are different steps and methods in quantifying climate risks.

In climate change risk assessment, scenario planning is crucial, wherein different future climate conditions are envisioned based on varying levels of greenhouse gas emissions. These scenarios help decision-makers navigate uncertainties and understand the range of potential climate risks. Financial stability also hinges on quantifying climate risk, as financial institutions, investors, and insurers need to understand their exposure to climate-related losses and liabilities.

Ultimately, quantifying climate risk enables informed decision-making across sectors. It provides decision-makers with essential information to understand the potential consequences of climate change and take appropriate actions to manage and mitigate climate risks. This is particularly crucial for climate risk management, as businesses, governments, and communities can prioritize resources effectively and implement measures to reduce vulnerability and enhance resilience.

What is climate change risk assessment

A crucial aspect of climate risk management involves conducting comprehensive risk assessments. These assessments involve evaluating current and future vulnerabilities to climate-related hazards, considering factors such as infrastructure resilience, economic stability, and social vulnerability.

By quantifying risks and identifying potential impacts, decision-makers can develop targeted strategies to build resilience and reduce vulnerability.

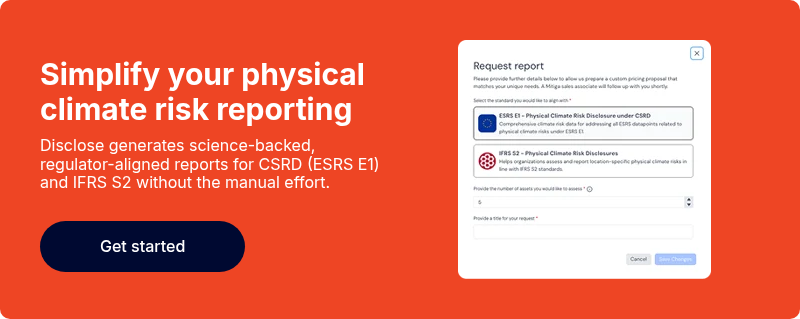

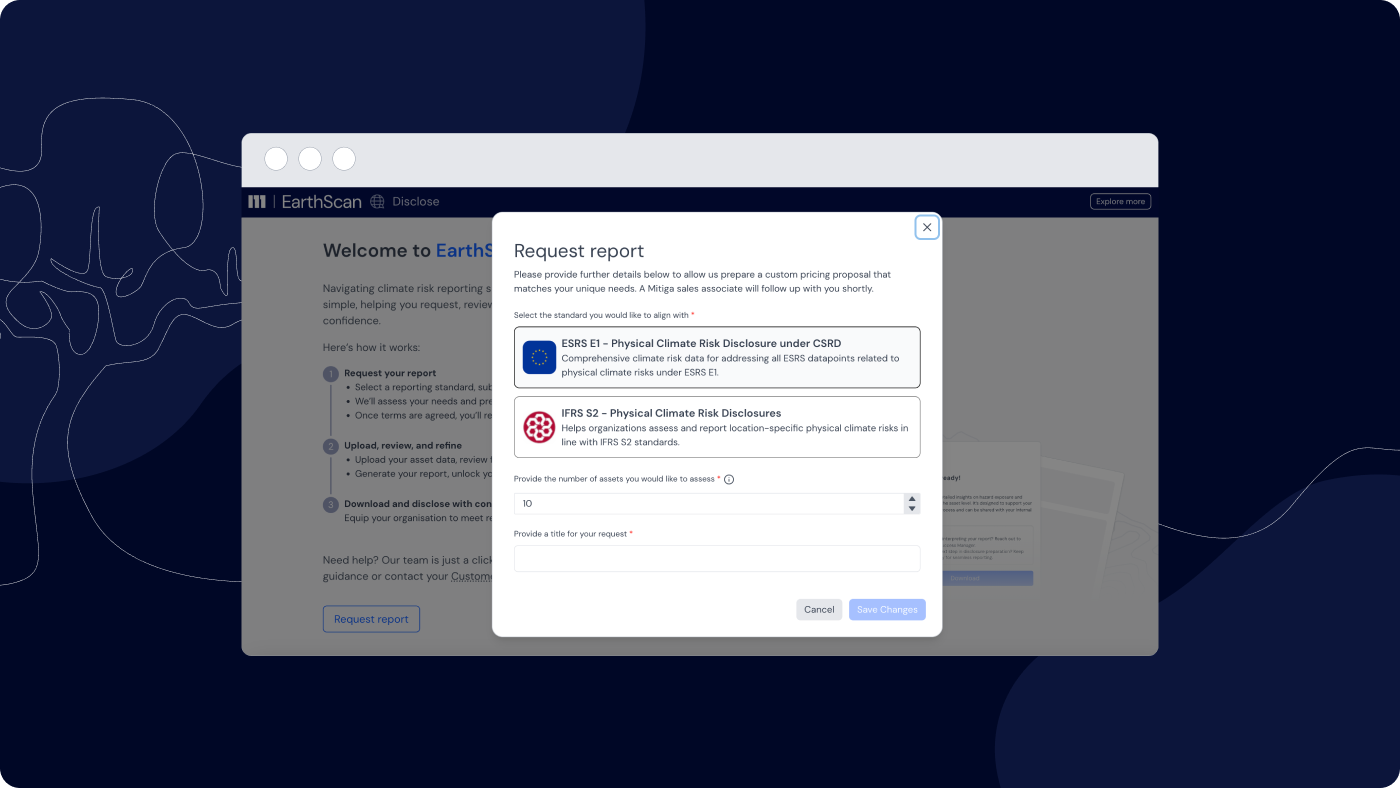

Businesses need easy-to-understand and accessible data to help with climate change risk assessment. To better understand and address climate risks, tools like EarthScan have been developed to help analyse, report and act on each business portfolio’s exposure to climate risk.

EarthScan provides valuable insights into the vulnerability of business assets to climate-related hazards. In a few seconds, you can gain customised, asset-level insight into acute and chronic risks such as flooding, droughts and extreme temperatures. It helps businesses understand the climate change risks that can impact their assets from today and far into the future.

This in turn can help them plan their climate risk management strategies on mitigating and adapting to said climate risks, making their businesses more resilient in the face of climate change.

Mapping climate risks

In the section above, we introduced the importance of climate risk assessment and how tools like a climate risk map can help businesses better understand the climate hazards they are facing and will face in the future. In this section we dive deeper into mapping climate risks and why they are crucial for businesses in protecting their assets and building resiliency.

Businesses can use ‘what if’ scenario analysis to explore how climate impacts might affect the resilience of the organisation’s business model and strategy if it were to operate in that given scenario. Climate scenarios help organisations to understand their climate risks, and how they could evolve over time, to help them make informed strategic decisions about the future of their business and assets.

Climate scenarios are analytical tools used to explore the potential impacts of climate change under different socioeconomic conditions, as well as to understand how human development and associated emission pathways affect the natural world.

They help business leaders make informed decisions by considering multiple different future climate possibilities and impacts and allow them to better create strategies to mitigate damage to their assets and adapt.

Different scenarios exist for modelling physical risks and for modelling transition risks. Climate scenarios based on Earth System modelling are used to understand the physical risks posed by both shocks and stresses. Scenarios for exploring transition risk use a simpler climate model that takes energy markets and how they function into account.

To form a good idea of the range of likely risks they face and to comply with TCFD, organisations must use climate scenarios to explore their climate risk under at least three possible futures.

Simultaneously, they can consider how these risks play out over different time scales and how they manifest as individual climate-affected hazards. IPCC scenarios, or possible futures, include:

- Business as usual (emissions continue to rise throughout the 21st century with no further policy intervention – the worst-case scenario for emissions)

- Emissions peak in 2040 (emissions that do not increase beyond 2040 – the middle-of-the-road scenario)

- Paris-aligned (emissions are reduced in line with the Paris Agreement, which aims to keep global temperature increases to well below 2ºC – the best-case scenario)

By using climate scenarios to understand your organisation’s physical and transition risks, you will be better equipped to make critical decisions about where to allocate resources to protect your assets.

Wrapping up

As climate change continues to reshape our world, the urgency of addressing climate risks becomes increasingly apparent, and many governments are recognizing the need for transparent risk disclosures.

Through robust climate risk assessment and climate change risk management, businesses have the opportunity to mitigate and adapt to the worst impacts of climate change and create a more resilient world for generations to come.

Bringing together world-leading climate science, data modelling and machine learning, EarthScan can help your business in understanding the risks you face and helps you to comply with disclosure regulations. This will allow you to make confident investment decisions across time horizons and future climate scenarios.

Be ready for the future, start your free trial today.

.png)